You are currently browsing the tag archive for the ‘HR’ tag.

A company’s enterprise resource planning (ERP) system is one of the pillars of its record-keeping and process management architecture and is central to many of its critical functions. It is the heart of its accounting and financial record-keeping processes. In manufacturing and distribution, ERP manages inventory and some elements of logistics. Companies also may use it to handle core human resources record-keeping and to store product and customer master data. Often, companies bolt other functionality onto the core ERP system or extensively modify it to address limitations in the system. Because of the breadth of its functionality, those unfamiliar with the details of information technology may perceive ERP as a black box that controls just about everything. So it’s not surprising that when a company’s information technology becomes more of an issue than a solution, many assume that the ERP system needs replacing. This may or may not be true, so it’s important for a company to assess its existing ERP system in the context of its business requirements (as they are now and will be in the immediate future) and evaluate options for it.

A common scenario for a company to replace its ERP system is because the business has outgrown (or will soon outgrow) its capacity to handle transaction volumes. Replacement also becomes necessary when the system no long meets business requirements, as, for example, when it is too difficult to configure to specific requirements. This issue might have developed because the company’s business model has changed significantly since purchasing the system or because it had to adjust its go-to-market strategy, added a new product line, expanded geographically or made an acquisition. Another reason to change may be that for a company with an adequate on-premises ERP system migrating to the cloud can eliminate a substantial portion of work done by its IT staff, enabling the department to focus on more strategic efforts, reduce headcount or both. A shift to the cloud also may improve the performance of an ERP system, especially if it’s an on-premises system running on aging hardware and the organization does not have the resources to maintain the system well.

Then, too, there are less obvious reasons that necessitate replacement. ERP systems are inherently complex, as I have noted, because they cross multiple business functions in many types of business, each of which has its own requirements. Seemingly trivial elements, such as the particular sequencing of tasks in a process by an ERP system, may be irrelevant for many businesses but have a negative impact on some. For example, when customer orders are almost always infrequent, it doesn’t matter when in the sequencing of the sales order process the system records the use of credit to confirm that the order can go through. An order must be rejected if adding it to the customer’s outstanding balance will bring the account over its limit. However, if orders occur frequently, the ERP system must execute the credit check at the first step or customers routinely will exceed their credit limits. It’s easy to overlook a detail such as this in the software selection process and even in the initial implementation. If that happens, dealing with the credit limit may require software customization or a process workaround if the root cause is the application itself. However, replacing the existing ERP system often is necessary if there are multiple issues such as these and the overall impact of them is severe enough to be measured by a combination of monetary losses, wasted time, lax controls, an inability to measure performance or limited visibility of information and processes.

At the same time, replacing the ERP system may not be the most cost-effective solution to business issues. To gauge that aspect, an important first step is determining whether the process or data issues identified by users are the result of a poorly executed implementation. Midsize companies in particular don’t always get the most competent consultants to set up their software, especially if the consultant (or the individual running the project) is not familiar with the peculiarities of the company’s industry or its specific operating requirements. Checking in with user group members in a similar business is an easy way to confirm if the issue is systemic or simply a poor job of setting up the software. If, based on feedback from other users, the situation appears dire enough, it may be worthwhile to engage a new consultant to fix the mistakes of the first one.

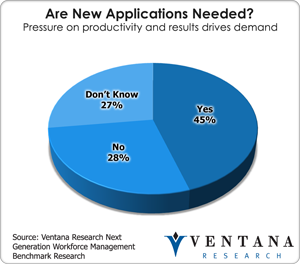

In some instances a “bolt-on” application (that is, software designed for easy integration with another, specific application) may be the most cost-effective way of addressing existing shortcomings. This is especially true for companies using a cloud-based system. Most ERP systems have rich functionality for handling core tasks such as accounting, human resources and inventory management. Yet the package a company is using may not have sufficient functionality for a specific process needed to run the business. For example, companies (particularly growing midsize ones) may find that their human resources department needs software to automate recruiting and onboarding of employees and that these capabilities are absent or insufficient in their ERP package. In our benchmark research on workforce management almost half (45%) of companies said they need new applications to address the full range of their human resources management requirements. In other cases, functionality necessary to manage the business may be missing. Companies that have a recurring revenue or subscription business usually find that the ERP system falls short of their requirements for invoicing. Bolt-on applications usually replace spreadsheets, ensuring that data is captured and available in a single controlled system where it can be accessed in an extended process (such as order-to-cash). Replacing desktop spreadsheets can save considerable time by automating tasks and eliminating the need to re-enter data into one or more systems. Having accurate and controlled data makes reports and metrics more reliable. It saves the finance and accounting departments time by eliminating the need to perform periodic reconciliations to ensure the accuracy of the data. Of course, the challenge with any bolt-on is that it is one more piece of software that requires attention, and integration with the core ERP system can pose challenges, especially over the long run.

In some instances a “bolt-on” application (that is, software designed for easy integration with another, specific application) may be the most cost-effective way of addressing existing shortcomings. This is especially true for companies using a cloud-based system. Most ERP systems have rich functionality for handling core tasks such as accounting, human resources and inventory management. Yet the package a company is using may not have sufficient functionality for a specific process needed to run the business. For example, companies (particularly growing midsize ones) may find that their human resources department needs software to automate recruiting and onboarding of employees and that these capabilities are absent or insufficient in their ERP package. In our benchmark research on workforce management almost half (45%) of companies said they need new applications to address the full range of their human resources management requirements. In other cases, functionality necessary to manage the business may be missing. Companies that have a recurring revenue or subscription business usually find that the ERP system falls short of their requirements for invoicing. Bolt-on applications usually replace spreadsheets, ensuring that data is captured and available in a single controlled system where it can be accessed in an extended process (such as order-to-cash). Replacing desktop spreadsheets can save considerable time by automating tasks and eliminating the need to re-enter data into one or more systems. Having accurate and controlled data makes reports and metrics more reliable. It saves the finance and accounting departments time by eliminating the need to perform periodic reconciliations to ensure the accuracy of the data. Of course, the challenge with any bolt-on is that it is one more piece of software that requires attention, and integration with the core ERP system can pose challenges, especially over the long run.

A company also may believe that it needs a new ERP system in order to consolidate data in a single system to facilitate analysis and reporting. In this instance, however, it may find that an operational data store, which integrates data from multiple sources for additional processing, will address all or most of its issues, especially if the company uses custom software or some niche application that supports its operations but is unavailable in an ERP system that otherwise meet its needs. A data store may prove to be a more practical choice because it’s much less costly and disruptive than replacing an otherwise well-functioning system. It also can provide flexibility in the longer term. As the company adds new applications, data from this new source can be fed into the operational data store. But be aware of challenges in setting up an operational data store or adding new system data feeds to it, using one usually requires an IT organization with the skills to maintain it over time.

A company also may believe that it needs a new ERP system in order to consolidate data in a single system to facilitate analysis and reporting. In this instance, however, it may find that an operational data store, which integrates data from multiple sources for additional processing, will address all or most of its issues, especially if the company uses custom software or some niche application that supports its operations but is unavailable in an ERP system that otherwise meet its needs. A data store may prove to be a more practical choice because it’s much less costly and disruptive than replacing an otherwise well-functioning system. It also can provide flexibility in the longer term. As the company adds new applications, data from this new source can be fed into the operational data store. But be aware of challenges in setting up an operational data store or adding new system data feeds to it, using one usually requires an IT organization with the skills to maintain it over time.

Many companies are loath to replace an otherwise well-functioning ERP system because doing so is expensive and usually disruptive to operations. Also, implementing a new system almost always requires retraining and some adjustments in operating procedures. Our research on the Office of Finance finds that on average companies are keeping their ERP systems one year longer today than they did a decade ago. Deciding whether to replace an ERP system is not always straightforward. The process is made more difficult because today organizations have many more software and data options than they used to. Few companies have the expertise in-house that will enable them to decide the best course of action. There may even be vested interests within the organization that will prevent them from making the best choice. Finding a truly independent advisor that understands both information technology and the specific business requirements can be the best way to sort out the options and help make the difficult technology decisions.

Regards,

Robert Kugel – SVP Research

Infor recently held its annual Inforum user group meeting, along with a series of sessions with analysts. The $2 billion business software company has products in the major categories of ERP (including enterprise financial management), human capital management, customer relationship management and performance management among others.

In their presentations, executives stressed three key themes.  One was the company’s focus on microverticals – that is, providing software that meets the needs of 10 specific types of business (for example, fashion, aerospace and defense, distribution and food and beverage). This focus on microverticals is an important part of the company’s strategy for differentiating its software from that of other vendors, even those that also have vertical industry applications with a broad offerings; Infor aims to make it faster and less expensive for companies in the microverticals to deploy its software.

One was the company’s focus on microverticals – that is, providing software that meets the needs of 10 specific types of business (for example, fashion, aerospace and defense, distribution and food and beverage). This focus on microverticals is an important part of the company’s strategy for differentiating its software from that of other vendors, even those that also have vertical industry applications with a broad offerings; Infor aims to make it faster and less expensive for companies in the microverticals to deploy its software.

The second was theme architecture. Infor’s ION middleware facilitates the integration of Infor’s and third-party applications, potentially lowering the cost for companies to implement and maintain a suite of business software. Its Business Vault serves as a central data repository of transactional and other data from multiple systems to enable immediate reporting and analysis from them. It enables integration of financial and operational data to use, for example, in business planning and performance management. Our benchmark research on finance analytics shows that companies whose software facilitates the use of analytics are able to obtain performance metrics sooner than those with less capable systems.

Third, Infor executives emphasized attention to making the business user experience more productive by (to paraphrase the speakers) “throwing off the tyranny of the superuser.” Toward this end, rather than presenting screens that offer every conceivable option, Infor attempts to simplify interactions by drawing on decades of experience in how work is actually performed. It utilizes the capabilities of today’s IT systems and an evolved palette of man/machine interactions to simplify training and speed process execution without sacrificing comprehensiveness; infrequently used commands and functions are hidden until they are needed.

In addition, to improve productivity Infor continues to refine Infor Ming.le, its social collaboration platform, which offers contextual interactions. In some of its applications, Infor is adding rewards, a component of what is generally called gamification, which I have written about. One example would be using it in purchasing to encourage policy compliance, such as choosing preferred vendors. By bringing a modern look to its applications – in many respects superior to its competitors’ designs – Infor also is attempting to deflect a perception sown by its competitors that Infor offers an amalgamation of old technology.

All three of these themes support the company’s cloud applications strategy. This year’s Inforum provided further evidence that Infor is at the end of its beginning, as I have put it. I mean it has completed the first stage of transforming a collection of discrete companies and applications into a coherent whole. From my point of view, Infor’s major challenge now is to accelerate its revenue growth, which increased just 6 percent in the quarter ending in July, even as its software license sales were up 22 percent. That is, the impact of rapid gains in new software license sales was diluted by the much slower growth in maintenance revenues, which were up just 2 percent. To increase revenue faster, Infor wants its existing customers to move from their on-premises deployments to its software-as-a-service (SaaS) offerings. The company insists that it can deliver substantial savings to customers by lowering their total cost of ownership (including hardware and the costs of operating and maintaining the application) and improving performance (often, these systems are running on older servers and may not have been optimally configured) while charging a subscription fee that can double the current maintenance charge. It’s no coincidence that the three main themes of Inforum are essential to make migrating to the cloud an attractive option for customers and a profitable one for Infor.

It is likely that even modest success in migrating its installed base would have a major impact. If Infor can convert 4 percent of its existing customers to SaaS each year, its annual revenue growth could increase to around 10 percent. Companies that operate their systems in Infor’s cloud would also find it easier to add more Infor applications (such as a performance management suite), further boosting subscription revenue growth. If Infor is able to demonstrate sales growth in low double digits, it would be able to go public and replace relatively expensive debt with equity. This, in turn, would substantially increase its net income and cash flow, enabling it to increase spending on sales and marketing to acquire new customers to further accelerate growth. Although converting a small fraction of its on-premises customers to a cloud deployment each year may not seem especially ambitious, it’s still too early to assess the feasibility of that happening.

One important factor in determining Infor’s near-term success is will be how well it executes its microvertical strategy. As I’ve noted many types of business find that cloud-based ERP systems do not meet their precise needs because of peculiarities inherent in their specific business. Infor’s success in migrating users to its SaaS offerings will be linked to how well it expands the capabilities and configurability of the software to meet the needs of these businesses.

To attract new customers and to provide its existing customers with a cloud alternative, Infor announced three offerings at Inforum. CloudSuite Financials brings together core financial management, consolidation and closing (including reconciliation management), treasury and cash management as well as “business intelligence,” which in this case means the ability to create reports and dashboards from the data stored in the system without having to purchase additional applications. CloudSuite Business comprises financials, human resources, supply chain management, project management, sales force automation and customer relationship management. These integrated suites of functionality can significantly reduce the time and cost required to implement a system. As names Financials and Business sound generic, but they incorporate the requirements of the targeted microverticals. For instance, CloudSuite Healthcare is designed for hospitals and other health delivery organizations. It comprises financial management, supply chain management, enterprise asset management, enterprise performance management, expense management, business intelligence and analytics tailored to the needs of this microvertical. Each of the suites incorporates Infor’s redefined user experience. Because the suites all run on its ION middleware, adding capabilities such as performance management is designed to be straightforward and well suited to operating in a multitenant environment.

At the conference, Infor executives reported early success with converting healthcare and government customers to its CloudSuite offerings. Our research shows that these types of organizations have far less mature information technology environments than most other kinds, so it makes sense that their business managers and executives would be eager to offload the management and support of their business applications to a third party for total cost and performance reasons.

At the conference, Infor executives reported early success with converting healthcare and government customers to its CloudSuite offerings. Our research shows that these types of organizations have far less mature information technology environments than most other kinds, so it makes sense that their business managers and executives would be eager to offload the management and support of their business applications to a third party for total cost and performance reasons.

A new development featured at the conference was Infor’s investment in creating more advanced analytics applications in its Dynamic Science Labs program. The idea is to build more easily consumed analytic applications tailored to the needs of the installed base of microverticals and business users that lack backgrounds in statistics or data science. Our research finds that two-thirds of companies make little or no use of advanced analytics and that a lack of training and data availability and inadequate software are among the reasons why. One of Infor’s pilot efforts is a price optimization application specifically aimed at distributors (one of the microvertical targets). Pricing software is a well-established category, as I have discussed, but applications in this category must be business-specific because of differences in the products sold, the information available to buyers and sellers, personal preferences and company cultures. For example, the requirements of travel and hospitality companies are different from those of retailers, and both are different from financial services. The factors driving value to customers, the availability of pricing information to sellers and buyers, time sensitivity and the determinants of buyer behavior patterns are just four of the considerations that determine the structure of the application and construction of the analytics that support users. It also matters that set prices are a feature of western cultures while negotiation is more the norm elsewhere. Our recent finance research shows that outside of specific verticals (such as hospitality and retail) price and profit optimization software has achieved limited adoption. From discussions we’ve had in the past several years, there are a range of reasons why companies have been reluctant to adopt price optimization software, including skepticism that the approach works, a lack of awareness of available software, ambiguity over who “owns” pricing in an organization and the related difficulty of implementing any change management initiative.

Infor has come a long way in its transformation. Yet there’s still  much more to accomplish in executing its strategy, especially in migrating existing customers to its multitenant SaaS offering. Building out its microverticals will be harder than it sounds. Adding new customers is also essential, but the market for its on-premises and cloud offerings is highly competitive, and Infor needs to build brand recognition. In addition the replacement cycle for ERP systems has been getting longer. Our research finds that the average age has increased one year in the past decade. Companies are reluctant to replace their systems because of the expense, risk and disruption. Until there is a long list of successes, most are likely to be reluctant to migrate an existing ERP system to the cloud.

much more to accomplish in executing its strategy, especially in migrating existing customers to its multitenant SaaS offering. Building out its microverticals will be harder than it sounds. Adding new customers is also essential, but the market for its on-premises and cloud offerings is highly competitive, and Infor needs to build brand recognition. In addition the replacement cycle for ERP systems has been getting longer. Our research finds that the average age has increased one year in the past decade. Companies are reluctant to replace their systems because of the expense, risk and disruption. Until there is a long list of successes, most are likely to be reluctant to migrate an existing ERP system to the cloud.

The measure of the success of Infor’s strategy and execution will be its ability to accelerate revenues over the next six quarters. Although the company is closely held, its financial statements are public. Infor is quite profitable when amortization of acquisition-related costs and intangibles as well as restructuring costs are excluded. I expect that achieving low double-digit revenue growth would enable the company to issue equity at a valuation attractive to its owners and in sufficient quantity to retire all or most of its debt. Being private has been advantageous because software companies in transition usually are shunned by public investors, but having its shares publicly traded now would enhance brand recognition, and eliminating interest expense would enable Infor to step up its sales and marketing efforts.

Regards,

Robert Kugel – SVP Research

Klout

Klout LinkedIn

LinkedIn Plaxo

Plaxo Twitter

Twitter Facebook Fan Page

Facebook Fan Page Facebook Group

Facebook Group Ventana Research Website

Ventana Research Website